Are CBDC’s The Way Forward?

The Central Bank digital currency (CBDC) can be used by individuals to pay businesses, businesses, and other CBDC for retail and financial institutions to conduct transactions in financial markets or wholesale. The current concept of the digital central bank currency is a well-known concept in the field of economics, where a central bank enables citizens to hold accounts with the central bank and provides a reliable and secure public means of saving and payment (retail or general-purpose CBDC). In the 1990s central banks began e-money like the avant-garde Finnish card store of value. [13] The concept was inspired by Bitcoin and similar blockchain-based cryptocurrencies.

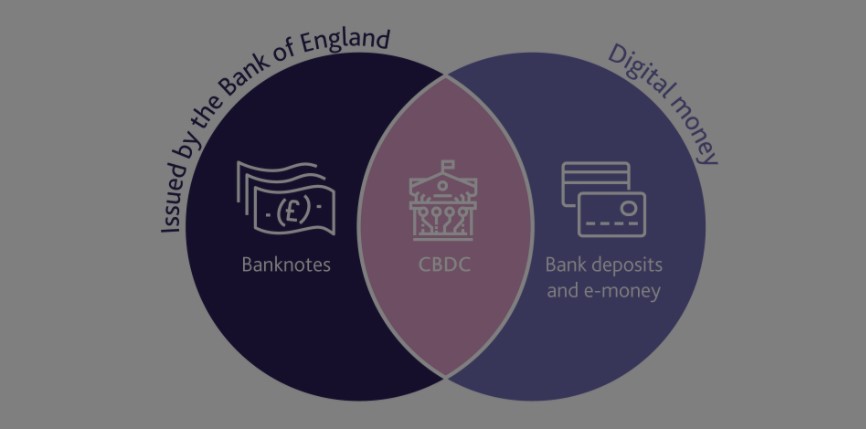

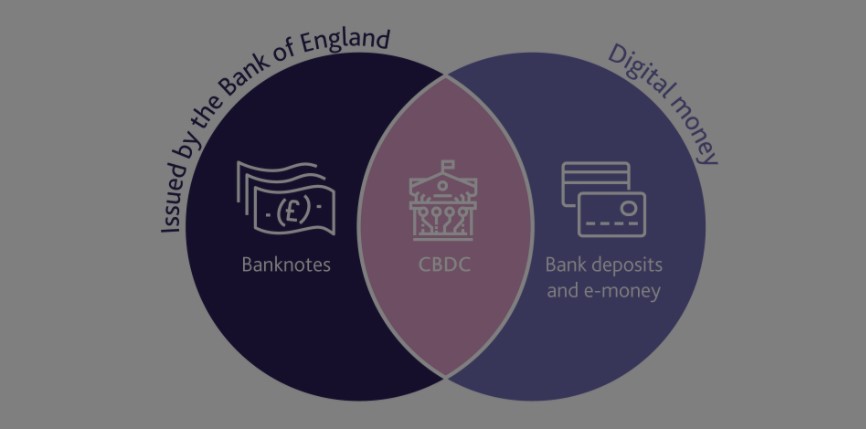

Simpler put, a CBDC ( short for Central Bank Digital Currency) is an electronic form of Central Bank money citizens can use for digital payments and as a store of value. It is a high-security digital instrument unlike paper banknotes and it is a method of payment, an accounting unit, and a store of value. A country can issue CBDCs as long as its government considers them legal tender (fiat currency) and, unlike physical cash, they are recognized as means of payment and act as a demand of the central bank or government.

Today’s digital currencies rely on the convertibility of digital codes issued by commercial banks to paper or cash and rely on commercial banks to have paper money available for this purpose. The new forms of money include virtual cryptocurrencies such as Bitcoin, stable coins such as Libra and Diem, and digital central bank currencies such as the Bahamas sand dollar. A report from the Bank for International Settlements says the wording “Central Banks Digital Currency” (CBDC) is not well defined, but that most new forms of central bank money will differ from the balance sheet of traditional reserve and settlement accounts.

This column argues that technological changes in money and finance are inevitable in the market economy owing to financial incentives, and highlights four important lessons that central banks can learn from history to deliver digital currencies and fulfill their public mandate.

The impetus for this radical shift came from China’s central bank, which started an experiment with a cash form called Central Bank Digital Currency (CBDC), which envisaged that cash would eliminate the need for paper money in the future. Subsequently, the central banks of other countries – China’s Peoples Bank of China (PBoC), the Bank of Canada (BOC), the central banks of Uruguay, Thailand, Venezuela, Sweden, Singapore, and others – evaluated the possibility of introducing digital currencies issued by central banks. CBDC also referred to as a digital fiat currency or digitally based money acts as a digital representation of a fiat currency of a country and is backed by an appropriate amount of foreign currency reserves (gold or foreign currency reserves ).

CBDC is defined as an asset in electronic form that fulfills the basic functions of paper currency: universal access to legal tender, a 21st-century version of Adam Smith’s social savings and trust money, reducing the cost of issuing and operating physical currency according to the IMF (2020) to 0.5-10% of GDP and reducing the monopoly return generated by the commercial banking system (Barrardear and Kumhoff 2016; Andolfatto 2019). The CBDC aims to bring the convenience and security of digital forms of cryptocurrencies and regulated, reserve-backed money outside the traditional banking system closer to the good world. A CBDC unit acts as a secure digital instrument similar to a paper invoice and can be used as a payment mechanism, value store, or official invoice unit.

While central banks around the world reflect on the risks and benefits of emission of digital central bank currencies, Beijing is likely to use frustration with the inefficiency of existing cross-border payment channels to bolster support for its vision of a low-cost alternative to building CBDC. As highlighted in China’s July 2021 White Paper on Digital Renminbi and Multi-CBDC Arrangements, a project called Project Inthanon Lionrock (later renamed Mbridge) aims to reduce dependence on corresponding banking channels. In theory, this means that payments from Chinese importers can be converted into digital renminbi accounts in a corridor that is subject to participating jurisdiction (the CBDC’s monetary authority) and credited to Thai exporters, with the central bank able to monitor transactions.

In addition to the Federal Reserve, the Office of the Currency Currency, Securities and Exchange Commission, Federal Trade Commission, Consumer Financial Protection Bureau, Federal Deposit Insurance Corporation, Office of Thrift Supervision, Financial Stability Oversight Council, Federal Financial Institution Examination Council, and Office of Financial Research has all interest in developing digital currencies backed by central banks, to name a few.

The potential of a digital currency to promote financial inclusion of citizens who do not have access to traditional banking services by using universal digital wallets in a traditional fiat – account field serves as an indicator that the market is ready for potential volatility events, such as the national acceptance of bitcoin in El Salvador. The proper introduction of a regulated digital currency that could be accessible without a formal bank account to mobile devices would enhance payment security and efficiency, ensure transaction integrity through distributed consensus and private key cryptography and meet the central banks’ “objectives of increasing financial inclusion and promoting the common good.

Observing this helps explain why Mu Changchun, head of the Peoples Bank of China Digital Currency Research Institute, endorsed CBDC’s global interoperability earlier this year. Fintech expert Ajay S. Mookerjee argues that a digital central bank currency (CBDC) would be a direct liability of the central bank, not a commercial bank, which would prevent commercial banks from accepting deposits from consumers and households, eliminating much of the physical infrastructure of the banking system, facilitating more effective supervision and regulation of the financial system and proving more inclusive.